Trying to navigate the ups and downs of the stock market and predict the future direction can seem like a complex and daunting task. However, as with almost anything, simplicity is often key. One of the most straightforward strategies is to pay attention to it Insiders movements.

After all, these corporate officers are privy to the inner workings of their companies. Therefore, when an insider is seen snapping up the stock of the company they work for, especially in large amounts, it sends a clear signal that they think the time is right to upload.

And when insiders buy distributed sharesIt’s a bright neon sign. Everyone loves passive income, and high-yield companies are sure to make it happen. Investors can sit back and collect profits, ensuring a return regardless of market fluctuations.

Against this background, our attention turns to two specific arrows. Not only do these names offer dividend yields of up to 7.5%, but they’ve also recently seen insider buys totaling six figures or more. Adding to their appeal, both stocks hold a unanimous “Buy” rating based on the analyst consensus. Let’s take a closer look.

Enterprise Product Partners (EPD)

The first is Enterprise Products Partners, a major player in the North American mid-hydrocarbon industry. EPD is one of the largest publicly traded public partnership firms on Wall Street. Its market value is $58 billion. The company’s business relies on an extensive network of assets to transport oil, natural gas and natural gas liquids.

The EPD network includes more than 50,000 miles of pipeline, transporting hydrocarbon products from wellheads to a chain of 25 fractionation facilities and 20 deepwater basins, along with storage assets capable of holding more than 260 million barrels of liquids, both gas and derivatives. oil. The company’s operations are centered along the Gulf Coast of Mexico, in Texas and Louisiana, but branch out into the Rocky Mountains, up the Mississippi Valley, the Northeast Appalachia, and into the Southeast.

The company’s revenue peaked a year ago, in the second quarter of 2022, and has been trending downward since then — although the company is still turning a profit. In Q2 2013, EPD brought in $10.65 billion in the top line, down 34% year-over-year. More importantly, revenue came in significantly below expectations, by $1.67 billion. On the bottom line, EPD earnings of 57 cents per diluted share was 1 percent lower than forecast.

In addition to revenue and earnings, EPD’s distributable cash flow also decreased year-over-year, from $2 billion in Q2 ’22 to $1.7 billion in Q2 ’23. Despite the decline in cash flow distributable, the company It raised the dividend for the second quarter to 50 cents per common share, from 49 cents in the previous quarter. New dividend payout annually to $2 and provides a solid yield of 7.5%. The dividend was paid on August 14th.

On the Inside the front, the last “media” purchase was made on August 7 by William Montgomery, a member of the company’s board of directors. Montgomery spent $1.33 million to acquire 50,000 shares of the company. His total equity in the company is currently $3.08 million.

When checking with analysts, we can find some equally optimistic thoughts. For analyst Salman Akyol, of Stifel, the EPD story should spark a lot of investor interest. The company’s ability to leverage increased oil production to increase revenue is a key point for this analyst, as is the company’s full coverage of its earnings.

“Between good crude prices, improved drilling and completion efficiencies, long flanks and some cost deflation, management is confident to see year-on-year crude oil production growth in the 500 to 700 million b/d range. We continue to favor the EPD story, given growth prospects and budget. Industry-leading publicity and financial resilience… We believe Enterprise has one of the strongest financial profiles in the midstream segment, and can withstand disruptions from the volatile macro environment,” said Akyol.

In gauging his position, Akyol rates EPD as Buy, and his $35 price target implies a one-year upside potential of 33%. (To watch Akyol’s record, click here)

In the bigger picture, EPD tallies a unanimous Strong Buy rating, based on 8 positive analyst ratings assigned in recent weeks. The shares are trading for $26.32, and the average price target of $32.88 indicates that a gain of approximately 25% awaits the stock in the next 12 months. (be seen EPD stock forecast)

Entravision Communications (EVC)

The second stock in today’s listing, Entravision Communications, is based in Santa Monica, California and is an important media provider in the Spanish-language segment of the US telecom markets. Entravision owns the television, radio, and overseas media stations, and focuses its operations on the largest market of Hispanics in the country. As a media owner, Entravision is a leading global advertising and ad technology solutions company, partners with big names like NBC, FOX and UniMas.

Entravision is a very diversified communications company. She has a large television presence, in addition to radio, but also works in digital communications and online content, and has a leading group of Spanish-language media influencers. In addition, Entravision has a premium network of broadcast audio providers. While the company’s business is centered in the United States and reaches nearly all of Latin America, Entravision’s communications network also reaches Europe and Africa, as well as South, East and Southeast Asia, 41 countries in total.

Entravision’s revenue and earnings have been tracking in opposite directions over the past several quarters, with revenue continuing to show year-over-year increases while EPS is declining. The latest report for the second quarter of ’23 confirms this. Quarterly advertising revenue rose to record highs, supporting a 23% year-over-year increase in net revenue. Net profit rose to $273.4 million, beating expectations by more than $11.2 million. However, on the bottom line, Entravision’s GAAP EPS was down year-over-year, from a gain of 10 cents to a net loss of 2 cents. The earnings per share loss came in at 6 per cent below estimates.

Although Entravision incurred a net loss, the company’s board of directors agreed to pay a 5-cent dividend to common stockholders, to exit on September 29. With an annual payment of 20 cents per common share, the EVC earns a yield of 5.22%.

On the Insider tradingWe found that company CEO Michael Christenson made two separate purchases earlier this month, acquiring a total of 202,170 shares at a cost of $782,098. As a result of these transactions, Christenson’s total holdings in the company are now estimated at $4.86 million.

All of this caught the attention of EF Hutton analyst Michael Albanese, who was impressed with Entravision’s proven ability to shift from television and radio to digital communications. Albanese sums up his view, saying of the company, “Entravision continues to implement a growth strategy focused on its digital marketing business. It has successfully transitioned from a traditional broadcast television and radio business into digital marketing with over 80% of revenue generated from the space… “

“The digital segment has continued to see cost pressures in the near term, but we expect margins to recover over the longer term as volume increases and focus is on finding cost efficiencies among the portfolio. We expect to see some near-term strength in the second half of 2013 in linear with expectations of increased spending on political and national advertising as the primaries approach.

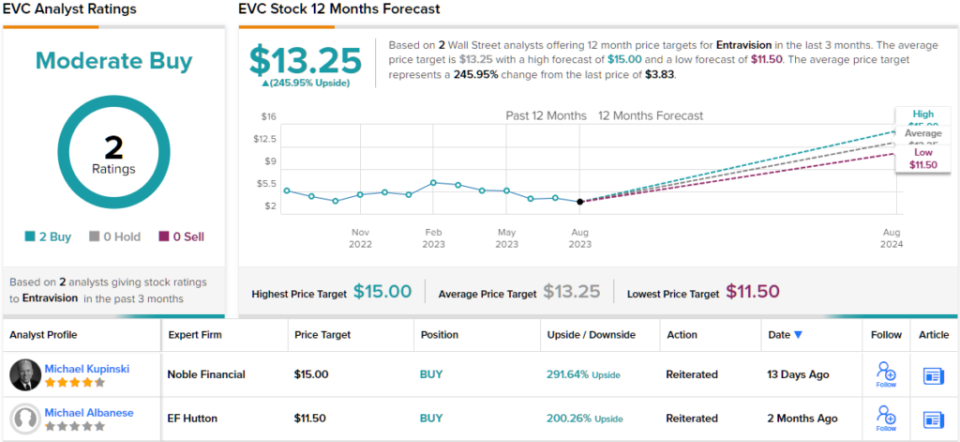

Breaking down his insights into practical advice for investors, Albanese rates EVC shares as a Buy. Its $11.50 price target suggests the stock will rise 200% in one year’s horizon. (To watch Albanese’s record, click here)

Although there are only two recent analyst reviews on file for Entravision, both are positive — giving the stock a Moderate Buy consensus rating. The shares are trading for just $3.83 and have an average price target of $13.25, which is more bullish than the EF Hatton Index, which means a one-year upside of roughly 246%. (be seen EVC stock forecast)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best stocks to buya tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.